![Harmony [logo]](i/logo.png)

![Harmony [logo]](i/print_logo.png)

- Home <

- Business review <

- Exploration overview <

- Papua New Guinea

Papua New Guinea

Exploration projects

The New Guinea mobile belt stands out amongst the world's most prospective geological terrains for porphyry copper-gold and epithermal gold mineralisation, with world class deposits including Grasberg-Ertzberg (copper-gold), Porgera (gold), and Ok Tedi (copper-gold). Importantly, the belt is under-explored.

Harmony has built a quality project portfolio comprising over 12 000 square kilometres of exploration and mining tenure in some of the most prospective mineral provinces and emerging gold and copper districts of the New Guinea mobile belt.

In the Morobe Province, Harmony has been active in exploration for the last seven years and the resource base has grown from 7.0Moz to over 45Moz (gold equivalent – refer to the resource growth profile below). Harmony owns 50% of this inventory, and the discovery cost for Harmony's equity ounces is less than $10/oz.

Outside of the Morobe Mining Joint Ventures (MMJV) area, Harmony continued to expand its 100%-owned tenement portfolio and exploration activities. During FY10, new applications were lodged to secure projects generated in the Southern Highlands and Central provinces. Exploration work began at Amanab in the Sandaun Province, and at Mt Hagen in the Western Highlands Province. These projects represent quality greenfield gold and copper-gold opportunities in highly prospective, under-explored districts of the New Guinea mobile belt.

Exploration achievements in PNG – FY10

- Wafi-Golpu resource expanded to:

- 16Moz Au, 4.8Mt Cu, 55,000t Mo

- Equivalent to a total gold endowment of 38.5Moz of which Harmony owns 50%

- PNG discovery cost now less than $10/oz, among the best in the world

- Significant expansion of exploration effort in PNG:

- Exploration portfolio grown to over 8 000km2 outside of the Morobe joint venture area

- Development of a new and exciting portfolio of first-class gold targets throughout PNG to underpin further growth in the region

Resource growth profile of the Morobe Mining joint venture in PNG

Highlighting impact of recent exploration success

PNG – Harmony tenement locations and major projects

Location of Harmony tenement and project areas in relation to the New Guinea Mobile belt and that of major PNG mines

and projects.

Grade comparison of selected South-East Asia porphyry systems

Bubble-size indicates the gold-equivalent endowment (based on US$950/oz Au, $4 412/t Cu at 100% recovery for both metals). The Wafi-Golpu porphyry is one of the highest grade porphry systems in south-east Asia.

Morobe Mining Joint Ventures (Harmony 50%)

The MMJV land holding comprises some 4 046 square kilometres of tenure encompassing the Wafi-Golpu and Hidden Valley projects and is a 50-50 joint venture between Harmony and Newcrest Mining Limited. The tenement package sits within a broader “strategic alliance” area where both Harmony and Newcrest operate as joint venture partners.

The Morobe district is a growing gold province. Currently the total known gold endowment is over 24.8Moz. Copper (4.8Mt), molybdenum (55,000t), and silver (84Moz) all add significant value to the known resources in the district.

During FY10, exploration expenditure for the joint venture totalled A$27.7 million. Work programmes were undertaken on 29 separate prospects in the MMJV area, with exploration statistics including:

- 29 931 metres diamond drilling

- 12 654 surface samples (soils, rock chips, trenches)

- Over 7 000 line kilometres of detailed airborne magnetics.

The outstanding highlight of the 2010 work programme was the discovery and definition of extensions to the Golpu copper-gold deposit.

The exploration programme is set to grow in FY11. The venture partners have approved a FY11 budget of A$48.9 million for the Morobe exploration joint venture (17.6% for greenfield and 82.4% for brownfield activities).

Wafi-Golpu will be advanced through pre-feasibility studies with 47 000 metres of drilling scheduled, while the strategic focus of exploration will shift to brownfield exploration around the Hidden Valley deposits and the development of greenfield targets in the regional project pipeline.

Wafi-Golpu

Wafi-Golpu brownfields exploration

Drilling at the Wafi-Golpu project during FY10 was particularly successful with the discovery of a new zone of copper-gold mineralisation directly adjacent to the Golpu orebody. As a result, the Golpu resource has been upgraded to 500.6Mt @ 0.95% Cu, 0.54g/t Au, and 111ppm Mo (equivalent to 8.8Moz of gold, 4.8Mt of copper and 55 000kg of molybdenum). On a gold equivalent basis, Golpu now stands at 30.9Moz (at a gold price of US$950/oz and a copper price of US$4 412/t). This represents an increase of 20Moz gold equivalent on the 2007 Golpu pre-feasibility resource, now making the deposit a truly world class discovery.

The outlook for additional growth at Golpu is excellent as the deposit remains open both along strike to the north and at depth. Drilling remains ongoing and new zones of high-grade mineralised porphyry have already been intersected which will add to the June 2010 model.

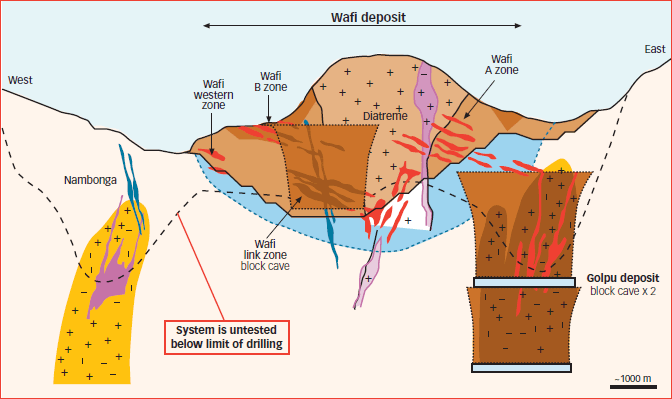

The Golpu copper-gold mineralisation displays features that are typical of most porphyry deposits with zoned alteration and mineralisation patterns. The resource takes this into account and can be categorised into two major components:

- “Porphyry” mineralisation: consists of the very high-grade mineralised core of stockwork veined and altered diorite porphyry. This component of the resource totals 173Mt @ 1.57% copper and 0.88g/t gold and accounts for approximately 60% of the contained copper and gold in the deposit.

- “Metasediment” mineralisation: consists of a halo of copper-gold stockwork vein mineralisation developed in the metasedimentary host rocks that surround the porphyry. The vein intensity and mineralisation is best developed at the diorite porphyry contact, and gradually decreases away from the contact. This style of mineralisation comprises 314Mt @ 0.59% Cu and 0.36g/t Au (ie approximately 40% of the deposit's contained copper and gold).

A third component of supergene mineralisation is also included in the Golpu mineral resource classification, but volumetrically this accounts for less than 3% of the deposit tonnage and less than 2% of the deposits contained copper and gold.

The current resource areas at the Wafi Golpu project (Wafi gold, Nambonga and the Golpu copper-gold deposits) are part of a large intrusive system with extensive and complex overprinting alteration patterns. Drill coverage outside of the existing resource areas remains patchy, and the full potential of the system is yet to be realised.

In addition to Golpu extension drilling, the FY10 exploration programme at the Wafi Golpu project included early stage prospect testing at the Northern Margin, Dokerton, and Miapili prospects. Results have been highly encouraging.

Northern Margin

The Northern Margin gold target lies midway between the Nambonga and Golpu deposits, where drilling across the Northern Margin of the Wafi diatreme has outlined a new zone of epithermal gold-silver mineralisation. The target was based on an area of elevated surface gold geochemistry adjacent to the diatreme contact, which had seen little previous drill testing.

A single hole was drilled, with results including:

| WR318: | 21.8 metres @ 1.45g/t Au 9.02g/t Ag from 66 metres |

| 17.8 metres @ 1.0g/t Au 5.22g/t Ag from 110 metres | |

| 58 metres @ 1.07g/t Au 5.27g/t Ag from 140 metres | |

| 35 metres @ 1.02g/t Au 1.9g/t Ag from 304 metres |

The Northern Diatreme Margin is sparsely drill tested and the results highlight the potential to significantly expand the known gold mineralisation footprint outside of the current resource areas.

Follow-up drilling to determine the potential size and tenor of this new zone of mineralisation will be scheduled as drill capacity becomes available in FY11.

Miapili

Miapili is a grassroots prospect located within the Wafi Transfer Structure, approximately 900 metres north-east of Golpu. Initial drilling targeted a discrete magnetic anomaly. The drilling intersected porphyry-related vein stockwork mineralisation and returned 97 metres @ 0.75g/t Au and 0.15% Cu from 387 metres in WR315.

Two follow up holes, WR323 and 326, were completed during FY10 with broad intervals of anomalous stockwork mineralisation encountered:

| WR323: | 6 metres @ 0.32g/t, Au 0.12% Cu from 515 metres |

| WR326: | 78 metres @ 0.2g/t, Au 0.09% Cu from 385 metres |

| 30 metres @ 0.18g/t, Au 0.12% Cu from 566 metres |

The mineralisation is similar in style to that at Golpu and additional follow up drilling is planned to determine the extent and source of this porphyry-related mineralisation in FY11

Dokerton

The Dokerton gold prospect also lies on the Wafi Transfer Structure, approximately 500 metres south-west of the Golpu deposit. Initial drilling was undertaken during the year to test along strike from broad anomalous gold intercepts in historic drill holes. WR320 returned significant intersections including:

| WR320: | 33 metres @ 2.32g/t Au from 83 metres |

| 27 metres @ 2.4g/t Au from 126 metres |

The results highlight the potential to extend the limits of the Wafi gold resource to the east and follow-up drilling is scheduled for FY11.

Golpu – Section 21000N:

June 2010 resource outline in relation to drill intercepts and the previous model.

Wafi Golpu Project:

Deposit locations and exploration targets

Wafi-Golpu concept study

The recent major exploration success at Golpu and step changes in mining and processing practices have led to a re-examination of previous studies and Harmony, as part of Morobe Mining Joint Ventures, entered into a new concept study in late 2009 on the project.

The current concept study on Wafi-Golpu builds on previous studies and evaluated a number of development alternatives for the Wafi gold system and Golpu copper system, either individually or in combination;

- Block cave on Cu-Au porphyry ore from Golpu (two lifts)

- Block cave on Wafi higher grade epithermal gold

- Small open pits based on oxide portion of Wafi and Golpu gold cap

- Large open pit encapsulating most of the Wafi resource (oxide and sulphide)

Schematic section

(looking north)

The Wafi-Golpu resources include porphyry copper gold mineralisation and high sulphidation epithermal gold deposits that contain both refractory and non-refractory gold mineralisation. Processing routes have been designed to accommodate the varying natures of these ores.

The study considered producing copper concentrate from Golpu porphyry and gold dore bars from the Wafi ores and the Golpu copper tails.

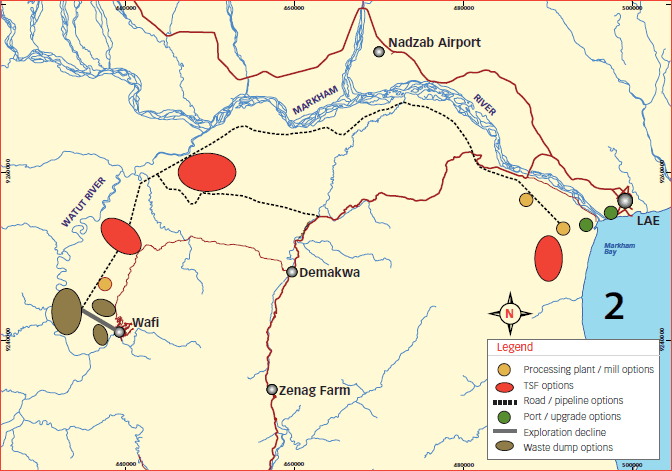

The location of Wafi-Golpu is advantageous for development. The deposit lies 80 kilometres by road from the deep water port of Lae, Papua New Guinea’s second largest city. The lodes lie under moderately mountainous terrain at ~500 metres ASL but are only 4 kilometres from the broad flat valley of the Watut River and further on to the Markham River and the coastal flats. The plan is to use this flat land for access and infrastructure, thereby mitigating the challenge of topography in this rugged country.

Infrastructure options

The concept study, which will be finalised early in FY11, has confirmed that the Wafi-Golpu project presents a viable business case that satisfies all of our tollgate hurdles. It is proposed to begin a pre-feasibility study to test the various development options.

The development strategy also generates future opportunities for value creation that will also be tested in the pre-feasibility study, including:

- Expansion of the Golpu resources to the north and at depth;

- Improved Wafi resource recovery through enhanced resource modelling;

- Development of Wafi at depth and the Northern and Western zones adjacent to Wafi A zone; and

- Further metallurgical process development and enhancement.

An 18-month timeframe has been allocated for the pre-feasibility study. Part of the study work will include early access to the orebodies for detailed geotechnical and metallurgical analysis. This work is expected to begin during FY11.

Wafi Golpu greenfields exploration

Wafi Transfer Structure

The Wafi Transfer Structure comprises approximately 17 kilometres of strike and includes the Wafi-Golpu project area. There has been very little previous exploration and the area remains highly prospective for gold and porphyry copper-gold resources similar to those at Wafi Golpu.

A major regional exploration programme began during FY10 which included both grid-based and ridge and spur soil sampling, stream sediment sampling, rock chip sampling, magnetic interpretation and geological mapping. Over 2 100 surface samples were collected and results from the Bavaga and Pekumbe prospect areas were outstanding.

Bavaga

The Bavaga prospect lies approximately 5 kilometres north of the Wafi-Golpu project on EL1105. Results from stream sediment reconnaissance sampling have outlined a 2 kilometre by 1 kilometre +1g/t gold anomaly. Visible gold is readily panned from anomalous drainages. The area has not been explored previously owing to access issues. The anomaly represents a first-class grassroots gold target and follow-up ridge and spur soils and reconnaissance mapping and sampling are planned.

Pekumbe

The Pekumbe prospect lies approximately 5.5 kilometres south-west of Golpu on EL1103. The prospect was generated based on the results of reconnaissance mapping and stream sediment sampling. Initial reconnaissance samples collected in the fourth quarter of the year returned assay results of up to 25g/t Au, 64g/t Ag and 0.3% Cu.

Work during FY10 included some 9.5 line kilometres of geological mapping, 150 soil samples, 409 channel rock chip samples and 233 grab rock chip samples. Reprocessing and imagery of detailed airborne magnetics were also completed and results have outlined a distinct linear target with over 1.6 kilometres of strike.

Results received to date have been highly encouraging with numerous >1g/t Au values from in situ rock chips taken from mineralised sediment, fault pug, massive sulphide lenses and quartz-feldspar porphyry over the strike length of the magnetic target. Soil sampling results have outlined a number of drill targets with surface anomalies up to 0.4g/t Au and 0.2% Cu.

Hidden Valley brownfields exploration

Exploration in the region around Hidden Valley aims to add value through the discovery of major satellite resources, or to provide high grade ore to supplement feed for the Hidden Valley plant. This remains a key strategic focus for the exploration team in FY11.

Work during FY10 continued on integrating the geological and geochemical datasets with detailed helimagnetics to generate new targets. Channel sampling and mapping at the Tais Creek and Waterfall prospects on ML151 have outlined significant zones of carbonate-base metal-style gold mineralisation, directly south of the Hidden Valley orebody.

Waterfall

The Waterfall prospect lies immediately south of the Hidden Valley orebody in the footwall of the Hidden Valley fault. It comprises a stockwork vein network of carbonate base metal veins accompanied by gold mineralisation. Mapping suggests a dominant north-northwest structural control to the mineralisation, similar to the Kaveroi orebody. Initial channel sampling results include:

| TCR001: | 6 metres @ 3.07g/t Au |

| TCR002: | 20 metres @ 2.46g/t Au |

| 10 metres @ 1.61g/t Au | |

| 14 metres @ 2.36g/t Au |

Drilling to test the near-surface bedrock potential of the Waterfall prospect is scheduled to begin during the first quarter of FY11.

Tais Creek

Tais Creek is located approximately 700 metres south-west of Hidden Valley. Historic surface soil sampling defined a coincident gold-silver geochemical anomaly over the area, and review work recommended the prospect for drill testing in FY11. Channel sampling and mapping of tracks constructed to access the prospect has confirmed a major carbonate base metal system. Results to date include:

| TCR004: | 6 metres @ 14.85g/t Au from 436 channel samples |

| TCR004: | 4 metres @ 10.81g/t Au from 486 channel samples |

| TCR005: | 24 metres @ 1.71g/t Au |

The intercepts relate to zones of structurally controlled, thin quartz-carbonate-pyrite-base metal sulphide veins within strongly sericite altered granodiorite and metasediments. Elevated silver (up to 1 070ppm), lead, zinc and arsenic occur with elevated gold grades.

Morobe regional greenfields exploration

Regional work continued with the development of greenfields prospects on the broader tenement package. Some 6 400 surface samples were collected from 13 separate prospect areas. In addition, a detailed helicopter-borne magnetic survey was completed at the Morobe Coast to provide context for interpreting mapping and geochemical datasets. Key FY011 regional projects include the broader Kerimenge area, Morobe Coast and the Nimo and Giu prospects.

PNG exploration projects (Harmony 100%)

Harmony’s exploration activities outside of the MMJV were expanded significantly during FY10, with work programmes now under way at both the Amanab and Mt Hagen projects. A total of A$3.9 million was spent on greenfield exploration outside of the MMJV.

This trend is set to continue. A budget of A$14 million has been approved for FY11 greenfield prospect development on Harmony’s 100% owned PNG projects. The expanded programme will include work on two new project areas:

- Southern Highlands Project: Located approximately 50 kilometres south-west of Porgera where new exploration licence applications have been lodged to encompass several Porgera-style magnetic targets.

- Central Province Project: Covering a highly prospective portion of the New Guinea Mobile belt between the Tolokuma gold mine and Morobe Province. Several significant geochemical targets exist which have not been followed up by previous explorers.

Outside of the MMJV area, Harmony now holds interest in over 8 000 square kilometres of exploration and mining tenure in PNG.

Mt Hagen

The Mt Hagen project forms a contiguous block of tenure covering 1 330 square kilometres. It consists of two granted exploration licences (EL1596 and EL1611) and several tenement application areas (ELA 1864-1867). The tenements are located approximately 20 kilometres north-north-east of Mt Hagen and are readily accessible via the Highlands Highway that connects Lae and Porgera. The two main projects occurring here are Kurunga and Bakil.

The region is transected by a number of major regional transfer structures and numerous mineralisation styles have been mapped in the area, including porphyry copper-gold mineralisation, quartz sulphide vein stockwork mineralisation, and coppergold skarn mineralisation.

The Highlands regional stream sediment dataset (a European Union SYSMIN funded Mining Sector Support Programme – released April 2010) has highlighted the area north of Mt Hagen as an emerging copper-gold province. The dataset highlights several high order Cu-Au anomalies within a 200 kilometre long zone, extending from Malamunda in the west to the Yandera Cu-Au porphyry deposit in the east. Harmony’s Mt Hagen project tenements lie in the central portion of this zone and encompass some of the highest tenor Cu-Au anomalies in the dataset, with stream sediment sample assays of up to 4.08g/t Au and 1 200ppm Cu.

Kurunga

The focus of exploration activities during the year was the Kurunga prospect where local artisanal miners were winning gold from outcropping copper-gold skarn mineralisation. First pass drill testing was under way at year-end with four holes having been completed. Widespread gold and copper-gold anomalism was intersected in all holes drilled to date with initial results including:

| KUDD001: | 7 metres @ 2.55g/t Au, 0.44% Cu from 63 metres |

| 4 metres @ 2.76g/t Au from 167 metres | |

| KUDD002: | 9 metres @ 0.91g/t Au from 101 metres |

| KUDD003: | 10.5 metres @ 1.46 g/t Au from 9.8 metres |

Two styles of mineralisation were encountered in the drilling, suggesting potential for the existence of a major porphyry coppergold system. These include:

- Copper-gold mineralisation associated with magnetite skarn

- Epithermal gold mineralisation associated with quartz sulphide veining.

Drilling is scheduled for completion during the first quarter of FY11. Follow-up work will include a detailed helimagnetic survey for integration with surface geochemistry, geology and drill results.

Bakil

The Bakil prospect lies approximately 8 kilometres south-west of Kurunga. Geology of the prospect area is dominated by an extensive system of altered volcaniclastic sediments and intrusive units. Rock chip samples returned to date include assays of up to 9.3% Cu.

Greenfields reconnaissance work including ridge and spur soil sampling, mapping and rock-chip sampling of drainages continues.

Amanab

The Amanab project (EL1708) was granted on 6 July 2009 and comprises 932 square kilometres of tenure. The tenement is located approximately 160 kilometres north of the Ok Tedi copper-gold mine in the Sandaun Province of western PNG. Access to the area is by air via the regional centre at Vanimo some 180 kilometres to the north.

The project area encompasses one of 17 recognised alluvial goldfields in PNG. Major deposits at Porgera, Bougainville and Morobe (including Hidden Valley,Wau and Edie Creek) all have similar alluvial goldfields nearby.

A review of historical data highlighted several high-tenor stream sediment anomalies for follow-up work including Yup River, Biaka, Dio River, Akraminag, Mouri and Akrani North.

Initial sampling began in the Yup River area where historic stream sediment data outlined a +0.5g/t anomaly over a 7-kilometre by 3-kilometre drainage catchment. This work is set to continue, with additional ridge and spur soil sampling campaigns planned for the Biaka and Dio River prospects during FY11.

HARMONY ANNUAL REPORT 2010